Intermediate Term Optimism Index (Optix): Measuring Broad Market Sentiment Across Multiple Indicators

Why the Intermediate Term Optimism Index (Optix) Matters

Market emotions fluctuate faster than fundamentals. The Intermediate Term Optix captures those swings by combining many proven sentiment gauges into a single normalized index — ensuring no single input dominates the signal.

Clarity: Aggregates intermediate-term sentiment from multiple market sources into one objective score.

Context: Shows when optimism or pessimism has reached statistically excessive levels across the market.

Insight: Highlights points where emotional extremes align across indicators — moments often linked to short- to medium-term reversals.

How Traders Use the Intermediate Term Optimism Index (Optix)

Above 65% (Excessive Optimism): Indicates a broad range of indicators are showing elevated confidence. Historically, these zones have preceded periods of slower returns or mild pullbacks.

Below 35% (Excessive Pessimism): Suggests deep investor anxiety. Such extremes often align with conditions for a 1–3 month market rebound.

Between 35–65% (Neutral): Reflects balanced sentiment and allows trends to continue without strong emotional bias.

Failure Signals: If markets fail to rally after deep pessimism, it may indicate persistent supply and a continuing downtrend.

The Technical Bit

Calculation and components

The Intermediate Term Optix is calculated by observing a set of intermediate-term sentiment indicators that historically best capture extremes in market psychology.

Each component is scaled and bounded, ensuring no single reading can distort the index. This normalization allows the Optix to reflect broad consensus among various sentiment sources.

Typical components include:

Put/Call Ratios: Gauges speculative demand in options markets.

Mutual Fund Flows: Tracks investor money moving into or out of equity funds.

Futures Positioning: Captures how traders are positioned in index futures.

Sentiment Surveys: Reflect opinions of investors and advisors.

Price Ratios: Compare stock performance to safe-haven assets.

Interpretation:

Readings near 100% → extreme optimism.

Readings near 0% → extreme pessimism.

Most readings oscillate between 35–65%, with reversals often forming outside these bounds.

What This Means for Traders

The Intermediate Term Optix simplifies a wide array of sentiment data into a single, actionable gauge of market mood. It helps traders recognize when optimism or pessimism becomes widespread — a signal that the next major swing may be driven more by emotion than fundamentals.

Because sentiment extremes can persist, the Optix is most effective when combined with trend or momentum indicators that confirm whether prices align with crowd behavior.

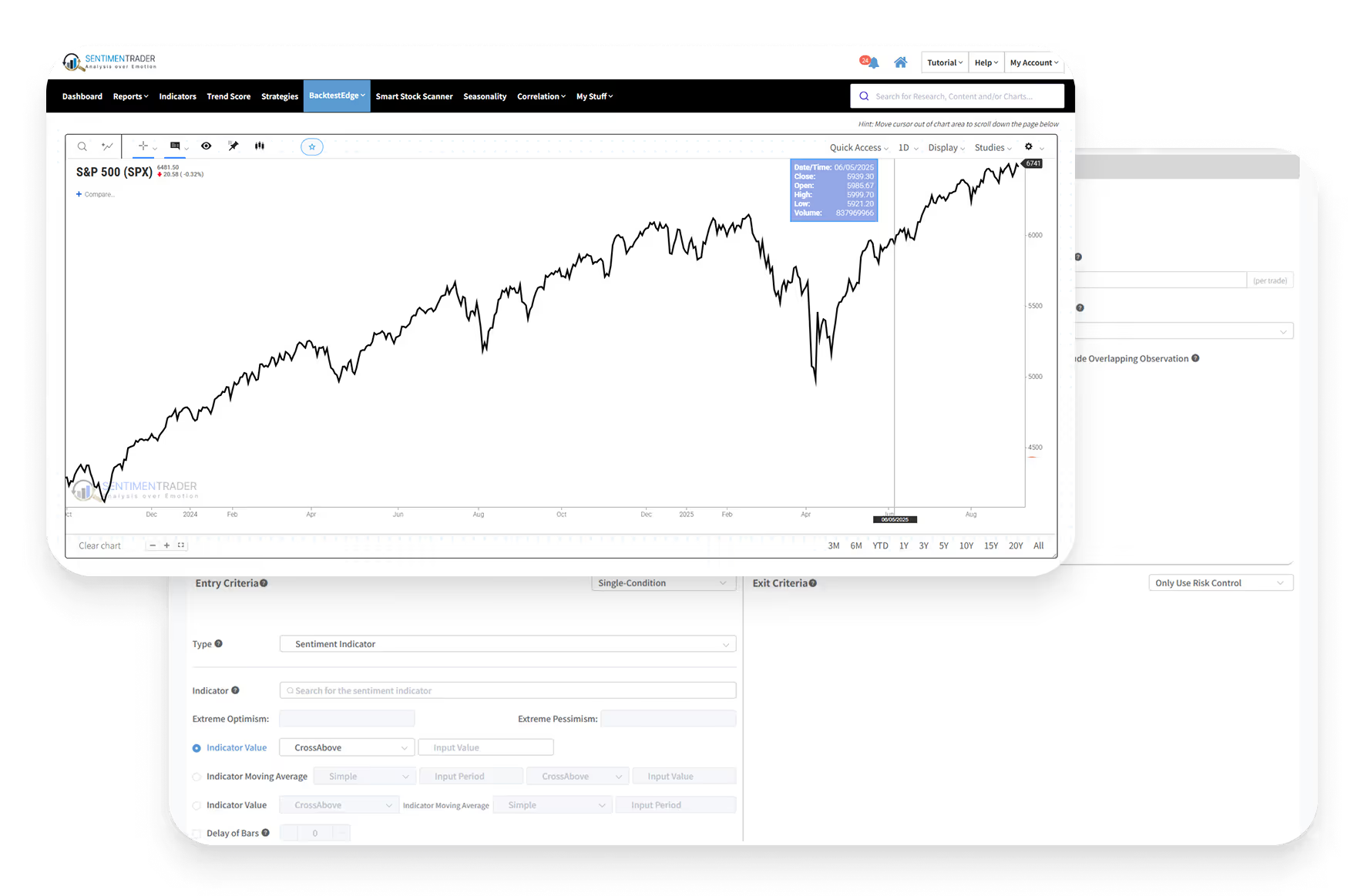

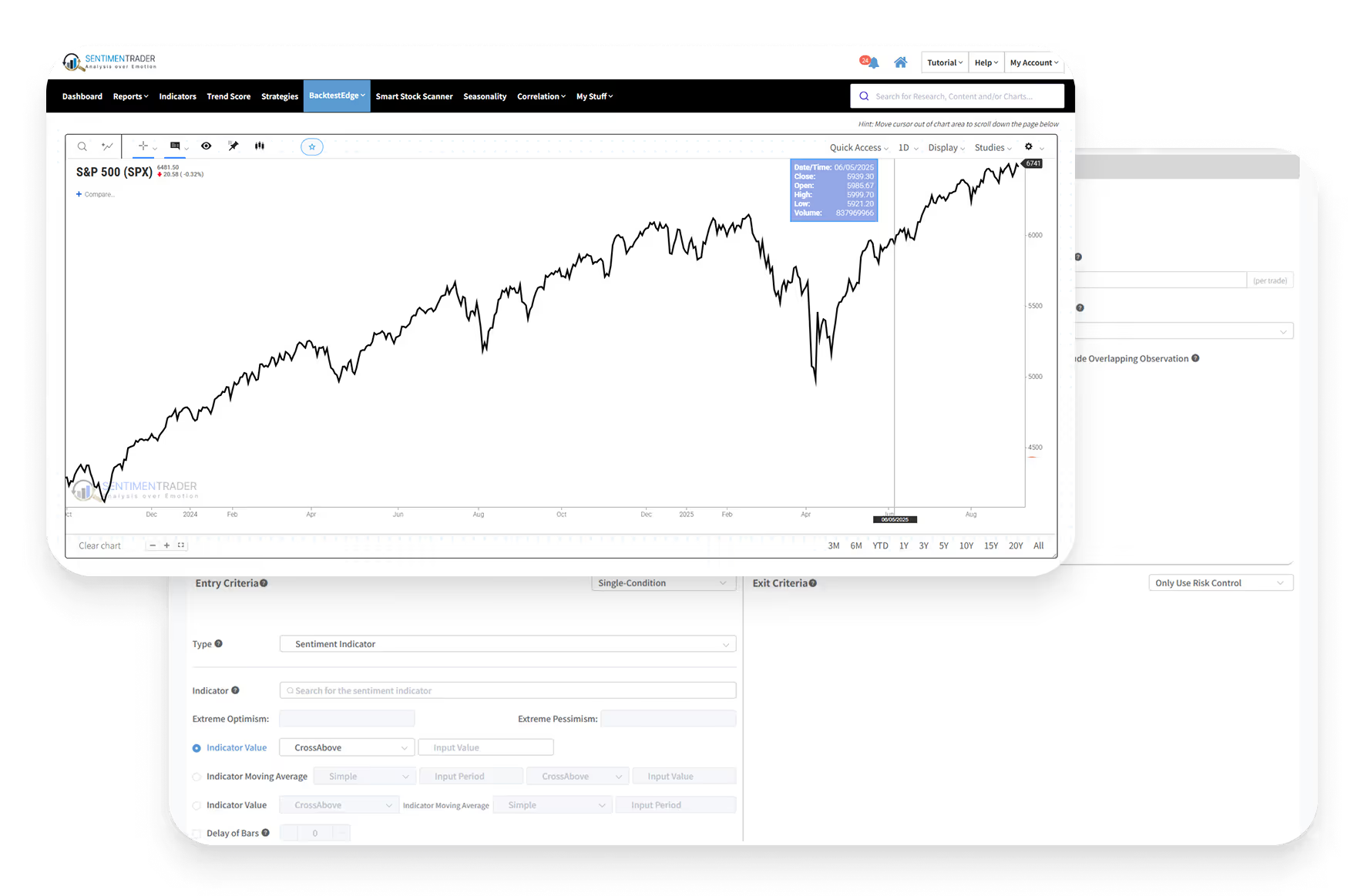

This is a proprietary SentimenTrader sentiment indicator, updated daily and available exclusively to subscribers. It can also be explored through SentimenTrader’s Proprietary Backtest Engine to quantify how sentiment extremes have historically influenced market outcomes.